Sunday, September 20, 2009

Kaskus

On May 23, 2006, the internet domain has been changed from .com to .us in response to a computer virus called Brontok that attacked the servers

Name

"KASKUS" is also an acronym from "KASak KUSuk" which translated to be "gossiping" in English. The administrator of the community chose this name so that when people are in a rush for a chat, they can go to Kaskus.

Sub-forums

As of Feb 4, 2009, Kaskus has the following forums and sub-forums:

* CAS-CIS-CUS, which is a forum where users can devolve with the current hot issues happening around the world. The CAS-CIS-CUS has sub-forums such as: Welcome to Kaskus, The Lounge, Surat Pembaca, Berita & Politik, Business Board, Can You Solve This Game, Debate Club, Disturbing Picture, Education, English, Girls & Boys Corner, Heart to Heart, and Jokes & Cartoon.

* LOE-KE-LOE, which is a forum where users can really find their suitable community based on hobbies, lifestyle and the likes. The LOE-KE-LOE has sub-forums such as: All About Design, AMH (Anime Manga Haven), Arsitektur, Computer Stuff, Cooking mencooking + restaurant guide, Fitness & Health Body, Gadget & Gizmo, Games, Handphone & PDA, Health & Medical, Lifestyle, Model Kit & R/C, Movies, Music, My Pets, Otomotif, Outdoor Adventures & Nature Club, Photography, Sports, Supranatural, Tanaman, Travellers, and Wedding.

* FORUM JUAL BELI (FJB), perhaps one of the most active sub-forums in Kaskus, it is fast becoming the Indonesian Craigslist where members post pseudonymous ads selling (and looking for) everything from Rp 50.000 (±US$ 5) USB flash disks to Rp 150.000.000.000 (± US$ 150.000) land rights.

KaskusRadio

KaskusRadio is an Indonesian Internet radio operated by Kaskus. It has more than 20 DJs and serves many kind of music.

facebook for Business

Here are 32 ways to use Facebook in your business.

Manage Your Profile

1. Fill out your profile completely to earn trust.

2. Establish a business account if you don’t already have one.

3. Stay out of trouble by reading the Facebook rules regarding business accounts.

4. Install appropriate applications to integrate feeds from your blog and other social media accounts into your Facebook profile. (Although you should be careful before integrating your Twitter feed into your Faceboook profile, as a stream of tweets can seem overwhelming to your contacts.)

5. Keep any personal parts of your profile private through Settings.

6. Create friends lists such as “Work,” “Family” and “Limited Profile” for finer-grained control over your profile privacy.

7. Post a professional or business casual photos of yourself to reinforce your brand.

8. Limit business contacts’ access to personal photos.

9. Post your newsletter subscription information and archives somewhere in your profile.

Connect and share with others

10. Obtain a Facebook vanity URL so that people can find you easily.

11. Add your Facebok URL to your email signature and any marketing collateral (business cards, etc.) so prospects can learn more about you.

12. Post business updates on your wall. Focus on business activities, such as “Working with ABC Company on web site redesign.”

13. Share useful articles and links to presentation and valuable resources that interest customers and prospects on your wall, to establish credibility.

14. Combine Facebook with other social media tools like Twitter. For example, when someone asks question on Twitter, you can respond in detail in a blog post and link to it from Facebook.

15. Before traveling, check contacts locations so you can meet with those in the city where you’re heading.

16. Research prospects before meeting or contacting them.

17. Upload your contacts from your email client to find more connections.

18. Use Find Friends for suggestions of other people you may know to expand your network even further.

19. Look for mutual contacts on your contacts’ friends lists.

20. Find experts in your field and invite them as a guest blogger on your blog or speaker at your event.

21. Market your products by posting discounts and package deals.

22. Share survey or research data to gain credibility.

23. Use Facebook Connect to add social networking features to your web site.

24. Suggest Friends to clients and colleagues — by helping them, you establish trust.

25. Buy Facebook ads to target your exact audience.

26. Read up on Facebook Beacon to see if it might be useful for you.

Use Network, Group and Fan Pages

27. Start a group or fan page for product, brand or business. Unless you or your business is already a household name, a group is usually the better choice.

28. Add basic information to the group or fan page such as links to company site, newsletter subscription information and newsletter archives.

29. Post upcoming events including webinars, conferences and other programs where you or someone from your company will be present.

30. Update your group or fan page on a regular basis with helpful information and answers to questions.

31. Join network, industry and alumni groups related to your business.

32. Use search to find groups and fan pages related to your business by industry, location and career.

Blogger Mobile

When you send texts to BLOGGR (256447) or photos to go@blogger.com from your mobile device they're automatically posted to your new blog.

How it works

MMS

* First send an MMS or email with the word 'REGISTER' to go@blogger.com.

* We'll reply with the address of your new mobile blog, plus a claim code.

* Post to your new mobile blog, or use the claim code to link your phone to a different blog.

* To unlink your device from Blogger, send an MMS or email with word 'UNREGISTER' to go@blogger.com.

or use SMS

* First send an SMS with the word 'REGISTER' to BLOGGR (256447).

* We'll reply with the address of your new mobile blog, plus a claim code.

* Post to your new mobile blog, or use the claim code to link your phone to a different blog.

* To opt out of receiving SMS messages to your phone, text STOP to BLOGGR (256447)

* To get help from your mobile device, text HELP to BLOGGR (256447)

* To unlink your device from Blogger, text UNREGISTER to BLOGGR (256447).

* Sending text messages to BLOGGR (256447) is currently available for US phone numbers only.

Devices and more

Blogger Mobile works with any device that can send texts via SMS, or email via MMS. Google does not charge for this service. Standard message charges apply.

Blogger Mobile is also built into some Sony Ericsson cameraphones, so you can post to your blog with just a few clicks.

Sony Ericsson

For more about mobile blogging, see: How does Blogger Mobile work?

iPhone users: Phones without MMS can still post to Blogger with SMS, or via email with Mail2Blogger.

Friday, August 28, 2009

Google Chrome

Currently only for Windows, Chrome is blazingly fast and is easily the quickest browser available. Based on Webkit, the same open-source engine that powers Apple Safari and Google's Android mobile platform, Chrome's interface is a drastic departure from other browsers. Instead of the traditional toolbar, Chrome puts its tabs on top. Moreover, the tabs are detachable: "tabs" and "windows" are interchangeable here. Detached tabs can be dragged and dropped into the browser, and tabs can be rearranged at any time. By isolating each tab's processes, when one site crashes, the browser does not.

Within each tab are individual controls, such as forward and back buttons. The search box and the address bar have been fused into a hybrid "Omnibox." The Omnibox includes not only suggestions for URLs culled from your browser's history, it also includes search suggestions from your search engine, and remembers site-specific search engine results. There's also Application Shortcuts, a feature that allows you to create desktop icons for Web-only applications, such as Gmail or Calendar. The stealth mode, Incognito, lets you surf without the history recording cookies.

Chrome lacks plug-ins, and there's the potential for high memory usage given that each tab is its own process. If you're addicted to Web apps and a need for speed, though, Chrome just might be the shine your browsing experience has been looking for.

Rebound time for your investment

No stock goes straight up. Even the hottest stocks hit cold spots when they might dip 20%, 25% or even more before they resume their climb. For instance, juice and soft-drink maker Hansen Natural (HANS, news, msgs), with a 185% gain, was one of the best performers over the past 12 months. But Hansen hit a rough spot in June 2004, sending its share price tumbling a nerve-shattering 33% in less than one month for no apparent reason.

Unfortunately, I have on occasion jumped on a hot stock just before it hit one of those bumps. I don't know about you, but no matter how great a stock looks on paper, it's hard to stay the course when you're 33% underwater.

The last time that happened, I vowed to figure out how to pick up these stocks after they've dipped, rather than before. The hard part, of course, is discerning the difference between a temporary dip and the start of a death plunge.

Here's a screen I devised for spotting hot stocks that have dipped but are good candidates to recover and continue their winning ways. These may be stocks that reported results below analysts' forecasts, are in a sector that is temporarily out of favor, or have been downgraded by analysts due to valuation.

First I'll identify hot stocks that have recently dipped; then I'll add fundamental factors to isolate the likely winners.

Spotting hot

I start by requiring at least 25% price appreciation over the past 12 months. That doesn't sound like much, but I'm interested in stocks that have room to run, not rockets that have already blasted off. In line with that thought, I exclude stocks that have doubled in price over the past 12 months. Increase that limit if it's too conservative for your tastes.

* Screening parameter: % Price Change Last Year => 25

* Screening parameter: % Price Change Last Year =< 100

When I say I'm looking for a dip, I mean a recent dip. I don't want strong performers from 10 or 12 months ago that have been heading down ever since. So I ditch those losers by stipulating that passing stocks must be trading no lower than they were six months ago. And I preclude stocks that have moved up too fast during the past six months. There's no way to precisely define how much is too much, so I arbitrarily set the maximum six-month price appreciation at 75%. Increase that figure if you feel adventurous.

* Screening parameter: % Price Change Last 6 Months => 0

* Screening parameter: % Price Change Last 6 Months =< 75

Finding the dip

Defining the dip is straightforward. I require that the current stock price must be at least 10% off its recent high.

* Screening parameter: Last Price <= 0.9* 52-Week High

(Due to my previous restrictions, the 52-week high typically occurred during the past two to three months.)

When researching the concept, I've found that the bigger the dip, the greater the chance that the stock won't recover. So I limit the drop to 25% off the recent high.

* Screening parameter: Last Price >= 0.75* 52-Week High

If you think that's too conservative, try increasing the maximum dip to 30% or 35% (0.70* 52-Week High or 0.65* 52-Week High).

Most of the stocks meeting my price-action requirements will likely see their dips turn into long-term downtrends. So, next, I added several fundamental factors to tilt the odds in my favor.

Keep the earnings coming

Changes in earnings forecasts usually move share prices. Downtrending forecasts are often your best clue that a dip could turn into something worse. Conversely, steady or increasing forecasts signal that the problems are likely short term.

Thus, I want to avoid stocks with downtrending earnings forecasts. The screener includes a parameter specifically for detecting changes in the current quarter's earnings forecasts.

* Screening parameter: Earnings Estimate Decreased Not Since (in the last quarter)

In English, that convoluted statement means that Wall Street analyst's consensus earnings forecasts for a company must not have decreased in the past three months.

Strong earnings-growth forecasts and strong price charts usually go hand in hand. Conversely, weak growth forecasts increase the odds that the dip could turn into a disaster. Many investors consider 15% as the minimum annual earnings growth for a growth stock. Consequently, I require at least 15% year-over-year forecast earnings growth for the next fiscal year. Try increasing the 15% minimum if you get too many hits, but I don't advise lowering it.

* Screening parameter: EPS Growth Next Year >= 15

Keep good company

Because of the pull that comes with generating huge trading commissions, institutional money managers -- mutual funds, pension plans and the like -- are more clued into the market buzz than we'll ever be. There is no stock they haven't heard of. If these pros don't own a stock, it's because they don't think they can make money on it. We can improve our chances of picking right by sticking with stocks owned by institutions.

Institutional ownership is the percentage of a company's outstanding shares owned by the big boys. The figure can run as high as 99%. How much is enough? I've had my best results sticking with stocks with at least 35% institutional ownership, and the higher the better.

* Screening parameter: % Institutional Ownership >=35

The profitability gauge

Profitability is a better predictor of a company's ultimate success than reported earnings because it measures how efficiently a company uses its assets to generate income. Return on equity (ROE) -- the most frequently used profitability gauge -- compares net income to shareholder equity, also known as book value.

ROE will be negative for companies reporting losses, but typically ranges between 5% and 20% for profitable companies. Most investors look for ROEs of at least 5%, and some pros require 15%. I set my minimum at 10%, which, in my view, is sufficient for this application.

* Screening parameter: Return on Equity >= 10

Keeping valuations reasonable

The most obvious problem with stocks that have already made a big move up is that buyers got carried away and the share price has outrun the fundamentals. However, in-favor stocks always seem expensive when you compare them to the market. Instead, I compare each stock's current valuation to its own history, and, to be safe, rule out stocks with price/earnings ratios higher than 90% of their historic five-year high.

* Screening parameter: P/E Ratio: Current <= 0/9*P/E Ratio: 5-Year High

This is a fast-changing screen. The first time I ran it last week, eight qualified stocks turned up. The next day, the screen listed nine stocks, but four were new. Three of the first day's stocks had disappeared from the list because they had moved up and no longer met the 10% minimum dip requirement.

Here's the list of the nine stocks from the second day's screen. Interestingly, each of the stocks represents a different industry.

Keep in mind that, given its fast-changing nature, you'll have to run your own screen to see the current list.

The stocks dipped for the same reasons I listed earlier. Some, such as Nabors Industries (NBR, news, msgs), dropped when their industry rotated out of favor with the market. Others, such as Knight Transportation (KNX, news, msgs), dropped when management reduced its sales or earnings forecasts, or reported earnings below analysts' expectations. Some, such as Cognizant Technology Solutions (CTSH, news, msgs), dipped on an analyst downgrade based on valuation.

Purchasing property without the use of your own capital

Typically, the easiest property to buy no money down is the one which has been on the market for a long term. Long term here would mean several months. Generally, the longer the period of time a property has been on the market for, the more motivated the seller becomes. Hence, it becomes easier to negotiate a lower price and hence get a good deal.

When negotiating with the vendor of a below market value property, the buyer should prove to the vendor that he has sufficient funds for the purchase of that property. This can be done by showing bank statements or any documents evidencing credit status. In this way, the seller will be assured that his loan will be satisfied from the resale of his property.

The buyer should also check the sellers mortgage statements to ensure that his offer price is able to meet this obligation. If the offer price is less than the mortgage amount, the mortgagee will not be satisfied on completion of the sale and hence the sale will not be allowed to proceed.

Several parties are involved in the no money down buying process. Firstly, a surveyor will value the property you are considering purchasing. If the price you are buying the property for is truly less than the true value of that property, this will be reflected in the surveyors valuation figures. Solicitors and financiers are also involved in ensuring the deal goes ahead as planned.

The property purchasing funds that you apply for need to be based on the valuation figure and not the purchase figure of that property. This way, your mortgagee may be able to lend you the entire amount of the purchase. Often, if the discount is big enough, you can also receive cash back from this type of deal. Again, this depends on the purchase, price, valuation figures and the mortgagee who is lending to you. Rental calculations are also taken into account especially if you are purchasing the property as a rental investment.

For a truly no money down deal, none of your money should be used for that transaction. This would also include monies required for conveyancing and surveyor fees etc. These additional expenses can be paid for using interest free credit cards and low interest loans. You can repay these loans later on using the equity in your property especially if the market is rising. Obviously, in a falling market, some of these strategies become more difficult to implement and you may need to use other methods. This is why it is so important for you to keep your eyes on the ball and ensure that you remain educated to the latest techniques and standards.

Thursday, August 27, 2009

Online Shop only for U$ 50

Dear friend,

Yesterday I just found a company focused in designing and developing website to fulfill our clients need. We also offer you a cheap and instant, CMS based Online Store. With only IDR 500,000.00 a year you can get an online store, your domain name (.com, .net, or .org) and hosting space.

This company also offer a complete Accounting system for a private company with over 200 report and general ledger only for IDR 2.000.000,- (in Indonesian language)

Anybody which is interested in this cheap product please contact me via email to Henky_k@yahoo.com.sg

Monday, July 20, 2009

Mutual Funds

An exchange-traded grantor trust share represents a direct interest in a static basket of stocks selected from a particular industry. The leading example is Holding Company Depositary Receipts, or HOLDRS, a proprietary Merrill Lynch product. HOLDRS are neither index funds nor actively-managed; rather, the investor has a direct interest in specific underlying stocks. While HOLDRS have some qualities in common with ETFs, including low costs, low turnover, and tax efficiency, many observers consider HOLDRS to be a separate product from ETFs.[7][23]

[edit] Hedge Fund ETFs

Hedge fund ETFs are a new type of an ETF. A hedge fund ETF tracks a hedge fund and follow a group of hedge fund's activity. These new Hedge Fund ETF's are offered by IndexIQ they include IQ Hedge Multi-Strategy Composite, IQ Hedge Global Macro, IQ Hedge Long/Short Equity, IQ Hedge Event-Driven and IQ Hedge Market Neutral

Each of these hedge fund ETF's follows a general hedge fund strategy (Event-Driven, Market Neutral ect...).[24]

[edit] Leveraged ETFs

A leveraged exchange-traded fund, or simply leveraged ETF, is a special type of ETF that attempts to achieve returns that are more sensitive to market movements than a non-leveraged ETF.[25] Leveraged index ETFs are often marketed as bull or bear funds. A bull ETF fund might for example attempt to achieve daily returns that are 2.0 times more pronounced than the Dow Jones Industrial Average or the S & P 500. A bear fund on the other hand may attempt to achieve returns that are -2.0 times the daily index return, meaning that it will gain twice the loss of the market. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps, derivatives and rebalancing to achieve the desired return.[26]. The most common way to construct leveraged ETFs is by trading future contracts.

History

Massachusetts Investors Trust (now MFS Investment Management) was founded on March 21, 1924, and, after one year, it had 200 shareholders and $392,000 in assets. The entire industry, which included a few closed-end funds represented less than $10 million in 1924.

The stock market crash of 1929 hindered the growth of mutual funds. In response to the stock market crash, Congress passed the Securities Act of 1933 and the Securities Exchange Act of 1934. These laws require that a fund be registered with the Securities and Exchange Commission (SEC) and provide prospective investors with a prospectus that contains required disclosures about the fund, the securities themselves, and fund manager. The SEC helped draft the Investment Company Act of 1940, which sets forth the guidelines with which all SEC-registered funds today must comply.

With renewed confidence in the stock market, mutual funds began to blossom. By the end of the 1960s, there were approximately 270 funds with $48 billion in assets. The first retail index fund, First Index Investment Trust, was formed in 1976 and headed by John Bogle, who conceptualized many of the key tenets of the industry in his 1951 senior thesis at Princeton University[2]. It is now called the Vanguard 500 Index Fund and is one of the world's largest mutual funds, with more than $100 billion in assets.

A key factor in mutual-fund growth was the 1975 change in the Internal Revenue Code allowing individuals to open individual retirement accounts (IRAs). Even people already enrolled in corporate pension plans could contribute a limited amount (at the time, up to $2,000 a year). Mutual funds are now popular in employer-sponsored "defined-contribution" retirement plans such as (401(k)s) and 403(b)s as well as IRAs including Roth IRAs.

As of October 2007, there are 8,015 mutual funds that belong to the Investment Company Institute (ICI), a national trade association of investment companies in the United States, with combined assets of $12.356 trillion.[3] In early 2008, the worldwide value of all mutual funds totaled more than $26 trillion.[4]

Usage

Since the Investment Company Act of 1940, a mutual fund is one of three basic types of investment companies available in the United States.[5]

Mutual funds can invest in many kinds of securities. The most common are cash instruments, stock, and bonds, but there are hundreds of sub-categories. Stock funds, for instance, can invest primarily in the shares of a particular industry, such as technology or utilities. These are known as sector funds. Bond funds can vary according to risk (e.g., high-yield junk bonds or investment-grade corporate bonds), type of issuers (e.g., government agencies, corporations, or municipalities), or maturity of the bonds (short- or long-term). Both stock and bond funds can invest in primarily U.S. securities (domestic funds), both U.S. and foreign securities (global funds), or primarily foreign securities (international funds).

Most mutual funds' investment portfolios are continually adjusted under the supervision of a professional manager, who forecasts cash flows into and out of the fund by investors, as well as the future performance of investments appropriate for the fund and chooses those which he or she believes will most closely match the fund's stated investment objective. A mutual fund is administered under an advisory contract with a management company, which may hire or fire fund managers.

Mutual funds are subject to a special set of regulatory, accounting, and tax rules. In the U.S., unlike most other types of business entities, they are not taxed on their income as long as they distribute 90% of it to their shareholders and the funds meet certain diversification requirements in the Internal Revenue Code. Also, the type of income they earn is often unchanged as it passes through to the shareholders. Mutual fund distributions of tax-free municipal bond income are tax-free to the shareholder. Taxable distributions can be either ordinary income or capital gains, depending on how the fund earned those distributions. Net losses are not distributed or passed through to fund investors.

Net asset value

Main article: Net asset value

The net asset value, or NAV, is the current market value of a fund's holdings, less the fund's liabilities, usually expressed as a per-share amount. For most funds, the NAV is determined daily, after the close of trading on some specified financial exchange, but some funds update their NAV multiple times during the trading day. The public offering price, or POP, is the NAV plus a sales charge. Open-end funds sell shares at the POP and redeem shares at the NAV, and so process orders only after the NAV is determined. Closed-end funds (the shares of which are traded by investors) may trade at a higher or lower price than their NAV; this is known as a premium or discount, respectively. If a fund is divided into multiple classes of shares, each class will typically have its own NAV, reflecting differences in fees and expenses paid by the different classes.

Some mutual funds own securities which are not regularly traded on any formal exchange. These may be shares in very small or bankrupt companies; they may be derivatives; or they may be private investments in unregistered financial instruments (such as stock in a non-public company). In the absence of a public market for these securities, it is the responsibility of the fund manager to form an estimate of their value when computing the NAV. How much of a fund's assets may be invested in such securities is stated in the fund's prospectus.

Average Annual Return

US mutual funds use SEC form N-1A to report the average annual compounded rates of return for 1-year, 5-year and 10-year periods as the "average annual total return" for each fund. The following formula is used:[6]

P(1+T)n = ERV

Where:

P = a hypothetical initial payment of $1,000.

T = average annual total return.

n = number of years.

ERV = ending redeemable value of a hypothetical $1,000 payment made at the beginning of the 1-, 5-, or 10-year periods at the end of the 1-, 5-, or 10-year periods (or fractional portion).

Turnover

Turnover is a measure of the fund's securities transactions, usually calculated over a year's time, and usually expressed as a percentage of net asset value.

This value is usually calculated as the value of all transactions (buying, selling) divided by 2 divided by the fund's total holdings; i.e., the fund counts one security sold and another one bought as one "turnover". Thus turnover measures the replacement of holdings.

In Canada, under NI 81-106 (required disclosure for investment funds) turnover ratio is calculated based on the lesser of purchases or sales divided by the average size of the portfolio (including cash).

ETF

Only so-called authorized participants (typically, large institutional investors) actually buy or sell shares of an ETF directly from/to the fund manager, and then only in creation units, large blocks of tens of thousands of ETF shares, which are usually exchanged in-kind with baskets of the underlying securities. Authorized participants may wish to invest in the ETF shares long-term, but usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets.[3] Other investors, such as individuals using a retail brokerage, trade ETF shares on this secondary market.

An ETF combines the valuation feature of a mutual fund or unit investment trust, which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund, which trades throughout the trading day at prices that may be more or less than its net asset value. Closed-end funds are not considered to be exchange-traded funds, even though they are funds and are traded on an exchange. ETFs have been available in the US since 1993 and in Europe since 1999. ETFs traditionally have been index funds, but in 2008 the U.S. Securities and Exchange Commission began to authorize the creation of actively-managed ETFs.[3]

Structure

ETFs offer public investors an undivided interest in a pool of securities and other assets and thus are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a securities exchange through a broker-dealer. Unlike traditional mutual funds, ETFs do not sell or redeem their individual shares at net asset value, or NAV. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks, varying in size by ETF from 25,000 to 200,000 shares, called "creation units." Purchases and redemptions of the creation units generally are in kind, with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets.[3]

The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Existing ETFs have transparent portfolios, so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at 15-second intervals.[3] If there is strong investor demand for an ETF, its share price will (temporarily) rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. The additional supply of ETF shares increases the ETF's market capitalization and reduces the market price per share, generally eliminating the premium over net asset value. A similar process applies when there is weak demand for an ETF and its shares trade at a discount from net asset value.

In the United States, most ETFs are structured as open-end management investment companies (the same structure used by mutual funds and money market funds), although a few ETFs, including some of the largest ones, are structured as unit investment trusts. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives.[4] Under existing regulations, a new ETF must receive an order from the Securities and Exchange Commission, or SEC, giving it relief from provisions of the Investment Company Act of 1940 that would not otherwise allow the ETF structure. In 2008, however, the SEC proposed rules that would allow the creation of ETFs without the need for exemptive orders. Under the SEC proposal, an ETF would be defined as a registered open-end management investment company that:

* Issues (or redeems) creation units in exchange for the deposit (or delivery) of basket assets the current value of which is disseminated on a per share basis by a national securities exchange at regular intervals during the trading day;

* Identifies itself as an ETF in any sales literature;

* Issues shares that are approved for listing and trading on a securities exchange;

* Discloses each business day on its publicly available web site the prior business day's net asset value and closing market price of the fund's shares, and the premium or discount of the closing market price against the net asset value of the fund's shares as a percentage of net asset value; and

* Either is an index fund, or discloses each business day on its publicly available web site the identities and weighting of the component securities and other assets held by the fund.[3]

The SEC rule proposal would allow ETFs either to be index funds or to be fully transparent actively managed funds. Historically, all ETFs in the United States have been index funds. In 2008, however, the SEC began issuing exemptive orders to fully transparent actively managed ETFs. The first such order was to PowerShares Actively Managed Exchange-Traded Fund Trust,[5] and the first actively managed ETF in the United States was the Bear Stearns Current Yield Fund, a short-term income fund that began trading on the American Stock Exchange under the symbol YYY on 25 March 2008.[6] The SEC rule proposal indicates that the SEC is not suggesting that it will not consider future applications for exemptive orders for actively managed ETFs that do not satisfy the proposed rule's transparency requirements.[3]

Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. Although these commodity ETFs are similar in practice to ETFs that invest in securities, they are not "investment companies" under the Investment Company Act of 1940.[3]

Publicly traded grantor trusts, such as Merrill Lynch's HOLDRS securities, are sometimes considered to be ETFs, although they lack many of the characteristics of other ETFs. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Funds of this type are not "investment companies" under the Investment Company Act of 1940.[7]

History

ETFs had their genesis in 1989 with Index Participation Shares, an S&P 500 proxy that traded on the American Stock Exchange and the Philadelphia Stock Exchange. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States.[8]

A similar product, Toronto Index Participation Shares, started trading on the Toronto Stock Exchange in 1990. The shares, which tracked the TSE 35 and later the TSE 100 stocks, proved to be popular. The popularity of these products led the American Stock Exchange to try to develop something that would satisfy SEC regulation in the United States.[8]

Nathan Most, an executive with the exchange, developed Standard & Poor's Depositary Receipts (AMEX: SPY), which were introduced in January 1993.[9] Known as SPDRs or "Spiders," the fund became the largest ETF in the world. In May 1995 they introduced the MidCap SPDRs (AMEX: MDY).

Barclays Global Investors, a subsidiary of Barclays plc, entered the fray in 1996 with World Equity Benchmark Shares, or WEBS, subsequently renamed iShares MSCI Index Fund Shares. WEBS tracked MSCI country indexes, originally 17, of the funds' index provider, Morgan Stanley. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. While SPDRs were organized as unit investment trusts, WEBS were set up as a mutual fund, the first of their kind.[10] [11]

In 1998, State Street Global Advisors introduced the "Sector Spiders", which follow the nine sectors of the S&P 500.[12] In 1999, the influential "cubes" (NASDAQ: QQQQ) were launched.

Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. As of May 2008, there were 680 ETFs in the U.S., with $610 billion in assets, an increase of $125 billion over the previous twelve months.[13]

Investment uses

ETFs generally provide the easy diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies.[4] Among the advantages of ETFs are the following:[7][14]

* Lower costs - ETFs generally have lower costs than other investment products because most ETFs are not actively managed and because ETFs are insulated from the costs of having to buy and sell securities to accommodate shareholder purchases and redemptions. ETFs typically have lower marketing, distribution and accounting expenses, and most ETFs do not have 12b-1 fees.

* Buying and selling flexibility - ETFs can be bought and sold at current market prices at any time during the trading day, unlike mutual funds and unit investment trusts, which can only be traded at the end of the trading day. As publicly traded securities, their shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using stop orders and limit orders, which allow investors to specify the price points at which they are willing to trade.

* Tax efficiency - ETFs generally generate relatively low capital gains, because they typically have low turnover of their portfolio securities. While this is an advantage they share with other index funds, their tax efficiency is further enhanced because they do not have to sell securities to meet investor redemptions.

* Market exposure and diversification - ETFs provide an economical way to rebalance portfolio allocations and to "equitize" cash by investing it quickly. An index ETF inherently provides diversification across an entire index. ETFs offer exposure to a diverse variety of markets, including broad-based indexes, broad-based international and country-specific indexes, industry sector-specific indexes, bond indexes, and commodities.

* Transparency - ETFs, whether index funds or actively managed, have transparent portfolios and are priced at frequent intervals throughout the trading day.

Some of these advantages derive from the status of most ETFs as index funds.

Types of ETFs

Index ETFs

Most ETFs are index funds that hold securities and attempt to replicate the performance of a stock market index. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. [4] Some index ETFs, known as leveraged ETFs or short ETFs, use investments in derivatives to seek a return that corresponds to a multiple of, or the inverse (opposite) of, the daily performance of the index.[15] As of February 2008, index ETFs in the United States included 415 domestic equity ETFs, with assets of $350 billion; 160 global/international equity ETFs, with assets of $169 billion; and 53 bond ETFs, with assets of $40 billion.[16]

Some index ETFs invest 100% of their assets proportionately in the securities underlying an index, a manner of investing called "replication." Other index ETFs use "representative sampling," investing 80% to 95% of their assets in the securities of an underlying index and investing the remaining 5% to 20% of their assets in other holdings, such as futures, option and swap contracts, and securities not in the underlying index, that the fund's adviser believes will help the ETF to achieve its investment objective. For index ETFs that invest in indexes with thousands of underlying securities, some index ETFs employ "aggressive sampling" and invest in only a tiny percentage of the underlying securities.[17]

Commodity ETFs or ETCs (Exchange Traded Commodities)

Commodity ETFs invest in commodities, such as precious metals and futures. Among the first commodity ETFs were gold exchange-traded funds, which have been offered in a number of countries. The first gold exchange-traded fund was Gold Bullion Securities launched on the ASX in 2003. Commodity ETFs generally are index funds, but track non-securities indexes. Because they do not invest in securities, commodity ETFs are not regulated as investment companies under the Investment Company Act of 1940 in the United States, although their public offering is subject to SEC review and they need an SEC no-action letter under the Securities Exchange Act of 1934. They may, however, be subject to regulation by the Commodity Futures Trading Commission.[18]

Exchange Traded Commodities (ETCs) are investment vehicles (asset backed bonds, fully collateralised) that track the performance of an underlying commodity index including total return indices based on a single commodity. Similar to Exchange Traded Funds (ETFs) and traded and settled exactly like normal shares on their own dedicated segment, ETCs have market maker support with guaranteed liquidity, enabling investors to gain exposure to commodities, on-Exchange, during market hours.

ETCs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent; for example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. What isn't clear to the non-professional investor is the method that these funds gain exposure to their underlying commodities. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure, such as a high cost to roll.

Bond ETFs

Exchange-traded funds that invest in U.S. Government bonds -- like the iShares Barclays 20+ Year Treasury Bond Fund, [NYSE: TLT], are known as Bond ETFs. They thrive during economic recessions because investors pull their money out of the stock market and into U.S. Treasuries. Because of this cause and effect relationship, the performance of Bond ETFs may be indicative of broader economic conditions.[19] There are several advantages to Bond ETFs such as the reasonable trading commissions they generate, but this benefit can be negatively offset by trading fees if bought and sold through a third party.[20]

Currency ETFs

In 2005, Rydex Investments launched the first ever currency ETF called the Euro Currency Trust (NYSE: FXE) in New York. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. In 2007 Deutsche Bank's db x-trackers launched EONIA Total Return Index ETF in Frankfurt tracking the euro, and later in 2008 the Sterling Money Market ETF (LSE: XGBP) and US Dollar Money Market ETF (LSE: XUSD) in London.

Actively managed ETFs

Actively managed ETFs are quite recent in the United States. The first one was offered in March 2008 but was liquidated in October 2008. The actively managed ETFs approved to date are fully transparent, publishing their current securities portfolios on their web sites daily. However, the SEC has indicated that it is willing to consider allowing actively managed ETFs that are not fully transparent in the future.[3]

The fully transparent nature of existing ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front-run its trades[citation needed]. The initial actively traded equity ETFs have addressed this problem by trading only weekly or monthly. Actively traded debt ETFs, which are less susceptible to front-running, trade their holdings more frequently.[21]

The initial actively managed ETFs have received a lukewarm response and have been far less successful at gathering assets than were other novel ETFs. Among the reasons suggested for the initial lack of market interest are the steps required to avoid front-running, the time needed to build performance records, and the failure of actively managed ETFs to give investors new ways to make hard-to-place bets.[22]

Exchange-traded grantor trusts

An exchange-traded grantor trust share represents a direct interest in a static basket of stocks selected from a particular industry. The leading example is Holding Company Depositary Receipts, or HOLDRS, a proprietary Merrill Lynch product. HOLDRS are neither index funds nor actively-managed; rather, the investor has a direct interest in specific underlying stocks. While HOLDRS have some qualities in common with ETFs, including low costs, low turnover, and tax efficiency, many observers consider HOLDRS to be a separate product from ETFs.[7][23]

Hedge Fund ETFs

Hedge fund ETFs are a new type of an ETF. A hedge fund ETF tracks a hedge fund and follow a group of hedge fund's activity. These new Hedge Fund ETF's are offered by IndexIQ they include IQ Hedge Multi-Strategy Composite, IQ Hedge Global Macro, IQ Hedge Long/Short Equity, IQ Hedge Event-Driven and IQ Hedge Market Neutral

Each of these hedge fund ETF's follows a general hedge fund strategy (Event-Driven, Market Neutral ect...).[24]

Leveraged ETFs

A leveraged exchange-traded fund, or simply leveraged ETF, is a special type of ETF that attempts to achieve returns that are more sensitive to market movements than a non-leveraged ETF.[25] Leveraged index ETFs are often marketed as bull or bear funds. A bull ETF fund might for example attempt to achieve daily returns that are 2.0 times more pronounced than the Dow Jones Industrial Average or the S & P 500. A bear fund on the other hand may attempt to achieve returns that are -2.0 times the daily index return, meaning that it will gain twice the loss of the market. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps, derivatives and rebalancing to achieve the desired return.[26]. The most common way to construct leveraged ETFs is by trading future contracts.

Sunday, June 21, 2009

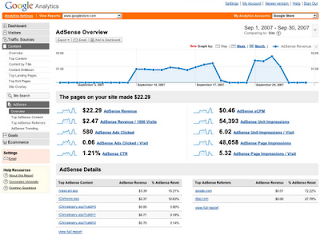

Google Analytics Account

For the past few months, more and more Analytics users have been invited to integrate their Analytics and AdSense accounts. Today that feature has become available to everyone. That means if you have an AdSense account, it's time to get it linked! Here's how:

Linking your Analytics and AdSense Accounts

1. Log in to AdSense

2. Click the link that says "Integrate your AdSense account with Google Analytics" on the Reports > Overview tab

3. Follow the on-screen instructions

You'll also notice that other sections of your Analytics account will show a new "AdSense Revenue" tab. You'll be able to compare how much of your AdSense revenue is coming from new visitors versus existing ones, and view revenue based on user language.

Enjoy your new data, and be sure to visit the Help Center if you have other questions about linking your accounts or reviewing your reports.

Adsense Payment

Payments Guide

Are you wondering when your AdSense payment will arrive? Trying to figure out whether you'll be paid this month, or next month? We've put together this guide to explain our payment process - from the five critical steps to setting up your account, to an overview of the life of a payment, everything you need to know is here.

1. 5 Steps to Getting Paid

2. Tracking Earnings

3. Payment Timelines or, "When am I paid?"

4. Holding Payments

5 Steps to getting paid

You must complete all the steps below to get your account set for your first AdSense payment. Keep in mind that your earnings will need to reach the appropriate thresholds before you can provide your tax details, select a payment method, and enter your PIN or phone verification number.

1. Check your address

Since payments and Personal Identification Numbers, which we'll describe below, are sent to the mailing address in your account, it's important to confirm the accuracy of your payment address and payee name. Keep in mind, especially, that checks and Western Union payments are made out to the payee name exactly as entered in your account.

If you need to correct any information, follow the instructions in our Help Center.

2. Provide your tax information

Depending on your location, we may be required to collect tax-related information from you. If you're required to provide tax information, you can do so on the Tax Information page, under the My Account tab. Our interface will help guide you to the appropriate forms and requirements for your particular situation.

Go to your Tax Information page now

3. Select your payment method

Depending on your payment address, there may be a number of payment options available to you, including checks, Electronic Funds Transfer, and Western Union Quick Cash. The easiest way to find out your payment options is to visit your Account Settings page and click the Payment Information [edit] link.

If you're already an approved publisher, choose your payment method now

4. Enter your PIN and phone verification number

When your earnings reach the verification threshold, we'll mail a Personal Identification Number to the payment address in your account. You'll need to enter this PIN into your account before we can send any payments to you. Your PIN will be sent by standard post and will take 2-3 weeks to arrive.

Depending on your location, you may also be asked to verify your phone number. As part of this process, our system will call you at a pre-arranged time, and you'll be required to dial in a verification number that appears in your AdSense account.

5. Reach the payment threshold in earnings

When your total unpaid earnings reach the payment threshold, we'll send you a payment at the end of the next month. This threshold varies depending on the reporting currency in your account.

Let's say, for example, that the payment threshold for your account is US$100. In this case, if your total unpaid earnings reached $100 during January and you completed the 4 steps above, we would send you a payment at the end of February.

If your total unpaid earnings haven't yet reached the payment threshold, they'll roll over to the next month and accrue until they meet the threshold.

Payments are sent within approximately 30 days of the end of the month. See the timeline of our payment cycle in the Payment Timelines section below.

Tracking Earnings

You can track your AdSense performance and earnings from the Reports tab of your account. The Reports tab includes two important sub-tabs: Overview and Advanced Reports, which will display day-to-day details about how much you're earning from AdSense. There's also important information included in the Payment History page, which is linked from the Overview as well as the My Account tab.

The Payment History page tracks the status of previously issued payments, as well as monthly account calculations. You can click the Earnings details link for any month to view your total earnings, as well as any adjustments made to your account. Once you've qualified for a payment, and your payment has been made, you'll see it listed on this page as Payment issued. Click on the link to see the payment details as well as the exchange rate used to calculate your local currency payment, if applicable.

Back to top

Payment Timelines or, "When am I paid?"

One of the most common questions we receive at AdSense support is, "when am I paid?" It's certainly an appropriate question, since you probably joined AdSense to earn money and not just because you like how pretty our ads are. So this section describes how the AdSense payment cycle operates throughout the month, to give you a good idea of when and how your payment will arrive.

Earnings calculated: On the last day of each month, our system identifies all accounts that have reached the payment threshold. All the accounts that have reached the threshold are then sent for approval. Within the first few days of the month, a link with specific earnings details will be posted to your Payment History page within the first few days of the month.

Payment issued: Within the next few weeks, a Payment issued line will be posted to your Payment History page, indicating your payment has been calculated. At this time, we'll have your payment processed and sent to you.

Payment arrives: The time it takes for your payment to arrive depends on form of payment you have selected.

* Standard delivery checks: generally arrive within 1-2 weeks of the mailing date in the U.S.; outside of the U.S. typically arrive in 2-3 weeks.

* Secure Delivery checks: generally arrive in 5-7 days.

* EFT payments: should arrive in your bank account within 2-4 days.

* Western Union Quick Cash payments: available for pick-up at a local agent the following day.

* Rapida payments: available for pickup at your local post branch two business days after they are sent.

If there are any problems with your payment, a notice will be posted on your Payment History page. If you haven't received your payment by the 25th of the next month, you can request a reissue.

Holding Payments

If you'd prefer not to receive payments for a while, we're happy to hold payments for you. Just set up a payment self-hold in your account.

Setting a hold will stop payments and your account will continue to accrue earnings. After you remove your hold, we'll send you a single consolidated payment for all your unpaid earnings. To set or remove a hold, follow these instructions.

Please note that all changes to your hold preferences should be made by the 15th of the month. Changes made to these settings after the 15th of the month may apply to either the current or next payment cycle.

Online Store with Wordpress

If you use Wordpress.org as your application for your blog, you may have ever heard a plug in that can make your blog as an Online Store. Can a blog at blogger.com be made as an Online Store too? Well, there is interesting information for those who use blogger as the application because a developer has created JavaScript that can make your blog as an Online Store, this script named simpleCart(js) + Paypal. With simpleCart(js) + Paypal, you can build your business by using blogger application.

Economic Recovery

For this rosy picture to play out, they are counting on the Obama administration and Congress to come through with a substantial stimulus package, at least $675 billion over two years.

They say that will get the economy moving again in the face of persistently weak spending by consumers and businesses, not to mention banks that are reluctant to extend credit.

If the dominoes fall the right way, the economy should bottom out and start growing again in small steps by July, according to the December survey of 50 professional forecasters by Blue Chip Economic Indicators. Investors seemed to be in a similarly optimistic mood on Friday, bidding up stocks by about 3 percent.

But in the absence of that government stimulus, the grim economic headlines of 2008 will probably continue for some time, these forecasters acknowledge.

“Without this federal largess, the consensus forecast for 2009 is for the recession to continue through most of the year,” said Randell E. Moore, executive editor of Blue Chip Economic Indicators, which conducts the monthly survey of forecasters.

Many economists are more pessimistic, of course. Nouriel Roubini at New York University, who called the 2008 market disaster correctly, wrote in a recent commentary on Bloomberg News that he foresees “a deep and protracted contraction lasting at least through the end of 2009.”

Even in 2010, he added, the recovery may be so weak “that it will feel terrible even if the recession is technically over.”

But Mr. Roubini is not among the economists surveyed by Blue Chip Economic Indicators. These professional forecasters are typically employed by investment banks, trade associations and big corporations.

They base their forecasts on computer models that tend to see the American economy as basically sound, even in the worst of times. That makes these forecasters generally a more optimistic lot than the likes of Mr. Roubini.

Their credibility suffered for it last year. They did not see a recession until late summer. One reason they were blindsided: their computer models do not easily account for emotional factors like the shock from the credit crisis and falling housing prices that have so hindered borrowing and spending.

Those models also take as a given that the natural state of a market economy like America’s is a high level of economic activity, and that it will rebound almost reflexively to that high level from a recession.

But that assumes that banks and other lenders are not holding back on loans, as they are today, depriving the nation of the credit necessary for a vigorous economy.

“Most of our models are structured in a way that the economy is self-righting,” said Nigel Gault, chief domestic economist for IHS Global Insight, a consulting and forecasting firm in Lexington, Mass.

Even if the economy begins to right itself by this summer, the recession would still be the longest since the 1930s, which was the last time the government engaged in widespread public spending to overcome the persistent inertia in consumer and business spending.

“The consensus says we are in the deepest part of the recession now,” Mr. Moore said. “But the stimulus package and much lower gasoline prices are expected to somewhat restore consumer confidence and personal spending and that will put us on the road back.”

There is a psychological factor that Robert Shiller, a Yale economist, hopes will come into play.

“If we have massive infrastructure spending and people feel that it is working, it could create a sense that we are O.K. and people will go back to normal,” he said. “The real problem is that we are on hold. Everyone is.”

The expectation of most forecasters, several report, is that most of the Obama administration’s stimulus will go for public works projects and tax cuts.

With this sort of stimulus, the gross domestic product, the chief measure of the nation’s output, should begin to rise — if not in the third quarter, then certainly in the fourth, the forecasters say, and the unemployment rate will finally peak at 8 to 9 percent by early next year.

“The job insecurity is very serious; that is the worst aspect of all this,” said Albert Wojnilower, a consulting forecaster at Craig Drill Capital. “But most upturns in the economy have begun with upturns in consumption, when people who still have jobs stop worrying about losing them.”

Saturday, May 09, 2009

Adsense Optimized Wordpress Themes to Maximize your Contextual Ad Earnings

As you probably know, effective ad placement is critical if you plan to make any significant amounts of money through Google Adsense or other contextual ad systems.

Using a blog template with distinct ad blocks and optimized ad placements will very likely help you increase your Click through rates and affiliate conversions. These customized blog designs are also known as Adsense Ready themes.

How are Adsense Ready Themes different from other blog templates?

A key element that is central to all Adsense Ready themes is their focus on integrating contextual ads around content. As you will notice, the ads and link units are carefully placed above, beside and below each individual post to maximize exposure and their click through potential.

Several themes will also allow you to easily place blocks of square ads within each post, which is one of the proven ways to receive the highest amount of ad clicks from the average blog visitor.

Here are some general characteristics of most Adsense Optimized themes:

* Built in Adsense blocks for easy ad insertion.

* Ads are active once the Adsense Publisher ID is inserted or changed

* Optimized Ad placement, colors and types according to Google’s guidelines

* Adsense linkunits and search are already included.

* Search Engine Friendly. Post and category titles are used for page titles etc.

Why should I use Adsense Ready Templates?

The main reason why you should use an Adsense ready theme is convenience. You don’t have to sift through too much code and there’s no need to make major adjustments to the template’s form.

In many instances, all you need is to insert your Adsense publisher ID and you’re done. This will probably only take a few minutes, which can be a huge time and effort saver.

You can probably hack any other Wordpress template to include ads but they can be a hassle if you are unfamiliar with how to optimize your ad placement. Most of these templates are not terribly attractive but I think they are functional and their ad placement is pretty decent.

I think Adsense Ready templates are very useful when you own dozens or hundreds of niche websites which use credited feeds or free content. Niche websites with high paying keywords will be naturally more profitable when you use templates with optimized ad placements.

Dosh Dosh’s List of 18 Adsense Optimized Wordpress Themes

As far as I know, this collection of Adsense Ready themes is the largest online. I’ve included a link to each theme’s home page and as well as a direct download link for your convenience.

Some of the screen shots were taken from the websites referenced and others were screen grabs of blogs running the specific theme. If you know of any other Adsense themes I’ve missed, leave a comment and I’ll add it to the list.

All of the themes should be compatible with Wordpress 2.0+. Feel free to check the theme’s homepage for more information on compatibility and installation.

Recommendations:

All of the themes are pretty similar in function, but I’ve had particularly high click-through rates and ad earnings with several of them and so I’ll like to highly recommend ProSense (#1) and BlueSense (#2).

This post will be updated often and I suggest that you subscribe to my blog feed in order to receive free notifications when new themes are added.

Adsense on twitter

Ads are displayed on any links you tweet out that have been shortened via the ow.ly URL shortener.

Try this:

1) On Google AdSense, create a new ad that is a 234x60 half-banner.

2) In HootSuite, click on Settings and paste the AdSense code. Then choose which Twitter profiles you'd like to display ads for.

3) In HootSuite, create a new tweet. Add a link to this tweet by entering in a URL and clicking "Shrink it!" -- the URL will be shortened via the ow.ly URL shortener.

4) When you send the tweet, any users who click on the ow.ly link will be shown an AdSense ad in the top banner. With each click, there's a 50% chance it will show your AdSense code, and a 50% chance it will show HootSuite's AdSense ads.

5) Send out more tweets and start monetizing your links!

When you send a tweet with an ow.ly URL, you can also track clickthrough stats in HootSuite -- check out the "Stats" page.

If you choose not to show any AdSense ads for a Twitter profile, no ads will be displayed on ow.ly links sent out from that profile.

Adsense on facebook

Google is actively recruiting third-party developers with applications on Facebook to run Adsense ads within applications pages, VentureBeat has learned.

These aren’t just any old Adsense ads, according to our sources — developers have been inserting plain-vanilla Adsense into Facebook applications since the developer platform launched in May. Now, Google is specifically building this network for advertisers who want to be on Facebook, and will let advertisers run their ads across all Facebook apps that sign up for it.

Facebook has been clear about letting third-party developers sell ads on their own “canvas” pages on the site and keep all the revenue — a loophole that the Google seems to fit through just fine. See sample screenshots of what the Google ads will look like, taken here from Fantasy Stock Exchange and South Park Character Creator (and no, I don’t regularly use either app):

fantasy-stock-exchange-1.png

south-park-characters-1.png

Microsoft has already inked an exclusive deal with Facebook to sell ads on Facebook pages within the US. By selling ads on third-party applications, Google is doing an end-run around this deal.

When it comes to Facebook and social networking, Google is apparently firing on all fronts.

Building relationships with Facebook advertisers also allows Google to test how to successfully monetize third party applications before it introduces its own developer platform. Google is apparently set to make an announcement on November 5 that it will give third party developers access to user data in Orkut, its own social network which is popular in Brazil and India but not in most other countries. To this end, it is also actively recruiting third-party developers on Facebook to develop on Orkut, we are told.

Google is also rumored to be in a three-way competition with Microsoft and Yahoo to sell ads on Facebook’s own pages outside of the US. Like its two competitors, it is also rumored to be trying to buy a chunk of Facebook.

So far, only third-party startups that have launched ad networks for applications on Facebook, including those run by RockYou, VideoEgg, Social Media, Lookery and others. Some of these networks sell contextual text and video ads within an application’s pages. Some even sell ads on popular Facebook applications for less popular applications, so the latter group can try to convince Facebook users to add their application as well. Also of note: We’ve also been hearing rumors that Facebook is working on its own ad network for applications within Facebook.

Whether anyone can make big bucks from third-party applications is another question. We’re hearing from developers that all of these ad networks work about the same. We’re hearing some — those with 50,000 active users or more - are even getting enough to pay for their servers, room and board. That’s enough to avoid taking on funding while you work out your long-term business strategy.

Google has responded with the usual “no comment.”

6 Ways to Make Money Online with Facebook

1. Find new business clients. Whether you’re a consultant, a writer, a photographer, an illustrator, or any other kind of freelance or online business worker, you can find new clients using this popular social networking site. Read more about finding clients on different sites.

2. Use various apps that enable you to make money. Some examples include: MarketLodge or TwitCash. You might also want to include apps by other money making ventures like Tradebit. Check some services or affiliate programmes and see if they have a Facebook app that you can use.

3. Use Facebook’s Marketplace. The Marketplace offers you ways to sell your stuff - either old or new. You can even look for jobs.

4. Advertise your business or service using Facebook’s Classified Ads. Although you’re not allowed to advertise your business or service in the Marketplace, you can still advertise them using their Facebook’s ad service.

5. Promote links to your blogs or website. This way, you can attract people to whatever you’re selling or promoting on your blog or site.

6. Be a Facebook App Developer. If you have skills in developing online applications (like those popular apps like Warbook, SuperPoke, Graffiti, etc), you might want to consider promoting your services to individuals or companies who might want their own Facebook app.

So, how do you use Facebook? Do you try to make money online through this social networking site?

Thursday, April 09, 2009

Ad Review Center available to all publishers

We wanted to share a publisher's thoughts about the Ad Review Center, so we chatted with Jennifer McDonald, Account Manager at RealNetworks for sites such as rollingstone.com and film.com. Before using it, Jennifer says that "the concerns Real had... were mainly concerns about running competitive ads on our sites." But she says that by using the Ad Review Center, her team has been able to keep competitive ads from running. As she notes, "We are able to quickly review the ads before they run on our sites and block any ads that are considered competitive to our services."

The Ad Review Center is now available for all publishers utilizing placement targeting. You can get started with this feature by visiting your 'Competitive Ad Filter' page, located under the 'AdSense Setup' tab.

Before getting started, we strongly recommend keeping your review preference set to the default of 'Run ads immediately.' This will let you allow or block ads after they have run. If you choose the other option of 'Hold ads,' the ads will await review for 24 hours before being allowed to run automatically. Using the 'Hold ads' setting will keep ads from participating in the auction while they await review, potentially lowering winning bids and your AdSense earnings. Ads that you have blocked can't compete in the auction either, so we ask that you keep in mind the revenue impact of blocking ads or switching from the 'Run ads immediately' setting.

For more information about using the Ad Review Center, please visit our Help Center, and to start using it, please log in to your account.

Earning revenue from youtube videos just got easier

- Broadbandtv: "Broadbandtv is partnering with YouTube to bring the very best video program lineup to a growing and engaged online audience. Broadbandtv shows include hits from Fashion, Celebrity News, Sports, Technology, Comedy and Travel to top notch Spanish-language TV series like Somos Tu y Yo."

- Canadian Broadcasting Corporation: "CBC/Radio-Canada is Canada's national public broadcaster and one of its largest cultural institutions. CBC/Radio-Canada is available how, where, and when Canadians want it."

- The Orchard: "A global leader in digital music, video, new media and brand services, The Orchard offers family content like Gumby, Mr. Bill, My Favorite Martian, and other categories of content like music and comedy."

Second, we're happy to announce that video units now support 728x90 and 160x600 formats to more easily fit into your site. These two new formats will feature five video thumbnails - when a user clicks on one of the thumbnails, a full sized video unit will appear, along with accompanying ads:

728x90 video unit

728x90 video unit, expanded

160x600 video unit, expanded

You'll generate earnings for valid clicks or impressions on the ads which appear. To use the new formats, you'll need to create new video units by visiting your AdSense Setup tab. To choose the new content for your video units, you can edit any of your players or set up new video units dedicated to this new content. Please keep in mind that video units are currently only supported for English or Japanese-language accounts in the following regions:

Australia, Canada, France, Ireland, Italy, Japan, Netherlands, New Zealand, Poland, Spain, United Kingdom, United StatesFinally, if you haven't edited or made a new video unit recently, you may not have noticed that you can now preview the kinds of video that will show up in the unit, based on the filtering choices you've made. We heard that you wanted more insight into the types of content that would display, and we think this will help.

While you can use video units like any other ad, they're also a great addition to the content of your page. So we encourage you to use video units as you may have used embedded YouTube videos in the past - to add variety and interest for your users.

Make a date with data in Google Analytics

By integrating your AdSense account with a new or existing Analytics account, you’ll have access to in-depth reports about user activity on your site. In addition to the wealth of metrics already available in Analytics such as unique visitors and visitor language, you'll now have access to granular reports that break down AdSense performance both by page and by referring site. Armed with this new data about user behavior, you’ll be able to make more informed decisions on how to improve the user experience on your site and optimize your AdSense units to increase your revenue potential.

We've highlighted a few ways to use the integrated metrics below, but we encourage you to be creative! Come up with your own to discover how useful (and fun) new data can be:

- Discover untapped markets. Use the geographies report to determine which regions are under-represented in your site’s user base. Optimize your site’s content to attract more of these under-represented users.

- Drive high-earning traffic to your site. Use the 'Referring sites' report to determine where the users who are making you the most money are coming from. Focus your efforts on getting traffic from these sources.

- Delve deeper into AdSense reports. Use the visualization feature to look at trends in your site's AdSense performance over time, or by time of day.

Posted by Vineesha Malkani - AdSense Publisher Support

Wednesday, October 22, 2008 at 11:04:00 AM

Maximizing revenue by exposing your channels to the right advertisers

As you may know, you can set up your custom channels so that they're targetable by advertisers - these targetable custom channels are known as ad placements. By selecting the 'Allow advertisers to target this channel' checkbox on the channel creation page, you can enable brand advertisers to target their content to your audience directly on a CPM or CPC basis.Creating ad placements allows them to show up in AdWords, so that advertisers who create placement-targeted campaigns can include your content directly. What many publishers don't know is that this also makes your content available to Google's internal sales teams, who work closely with many advertisers looking to target a certain audience or type of content. With this in mind, we thought it would be important to mention a few best practices which will help advertisers and our internal sales teams target your content to help you maximize revenue:

First, take time to make sure your channel names and descriptions accurately describe your content and audience. By including descriptions that closely reflect your content, you'll also attract advertisers from those areas. Naming and descriptions are important.

On that note, our second tip: be very careful about changing the name of an ad placement. If an advertiser has already targeted one of your specific channels, the channel will become unavailable to the advertiser once you change its name. If you wish to rename a channel, we recommend creating a second channel with the new name, and then attaching both channels to your ad unit. Remember, you can attach up to five custom channels to an ad unit.

Third, use the 300x250 medium rectangle, opted in to both text and image ads. This is one type of targetable ad unit that's in high demand by Google's CPM advertisers. We recommend placing these units in line with your content, and describing them as they relate to the content. This combination of format and placement enables advertisers to use image, text, or rich media (including gadget ads) effectively. In feeds, we recommend opting in to both image and text in all ad units, as many of these advertisers only target with image ads into feeds.

Finally, as always, the most important tip for maximizing revenue from your ad placements is to create quality content that is visually appealing and attracts a quality audience. Many brand advertisers look at all placements before placing an advertising order to make sure the destination sites are in line with their brand and attract the type of audience they wish to target for a particular campaign.

Wednesday, March 04, 2009

Which Option Strike Price Should I Trade?

Option Trading Question

Can you blog about the strategies that you use to pick the option strike price and expiration month once you have identified a possible stock? Also are there any tools out there one can use to identify possible profit and loss and probability of success for option trading?

Option Trading Answer

Throughout my blog you will find that your option strategy is a function of your opinion. You have to nail down the direction, duration and magnitude of the move. Then you need to assess your confidence in; the market, your analysis and your recent performance. All of these factors will lead you to the optimal strategy and trade size.

If I have a long term grinding move in a stable stock and the market is neutral, I would probably opt for an ITM call that has a few months of life. I will be buying intrinsic value and the option will move point for point with the underlying. This gives me the latitude to take profits along the way. This is almost like a surrogate stock position.

If I am looking for an explosive move in a short period of time, I will buy a front month OTM option. That will give me the biggest bang for my buck and I can buy more contracts.

If I am fairly confident in the stock’s strength, but the market is volatile (like now), I might consider selling an OTM put credit spread. This strategy will give me more cushion. If the market moves against me, the stock should hold up well and the puts will expire. If the market falls apart I should have time to buy back my put spread before things get ugly.